How To Examine A P&L

ACTIVE DEAL PNL BREAKDOWN

Link to Loom for a visual breakdown

These are the exact notes I took while looking through it:

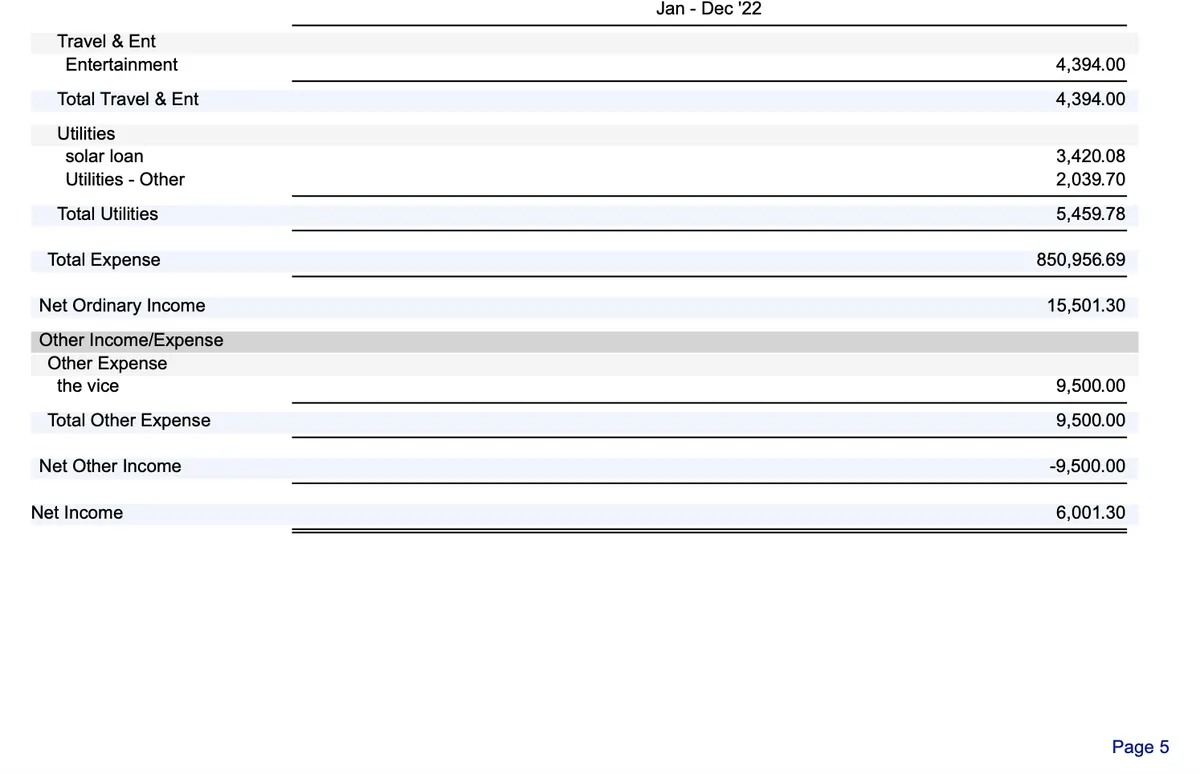

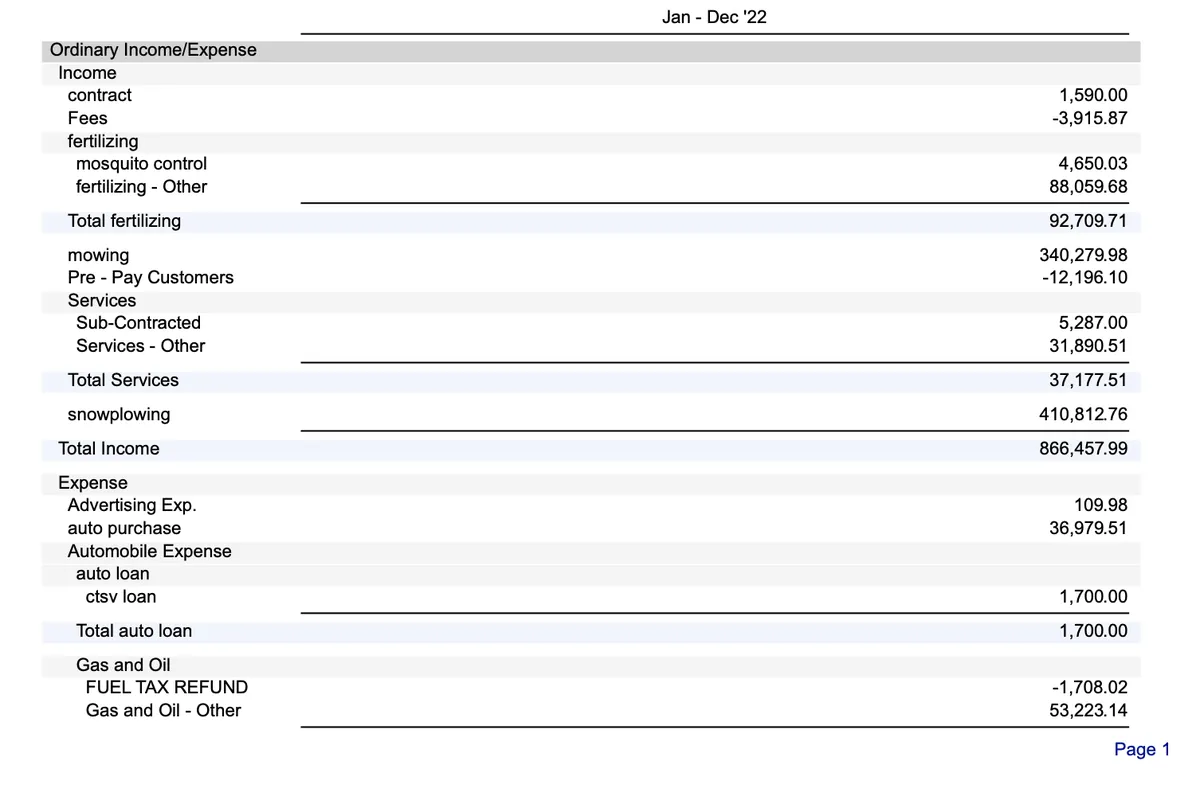

2022

- 800k income 2022

- 6k net income

- Sandbagging earnings

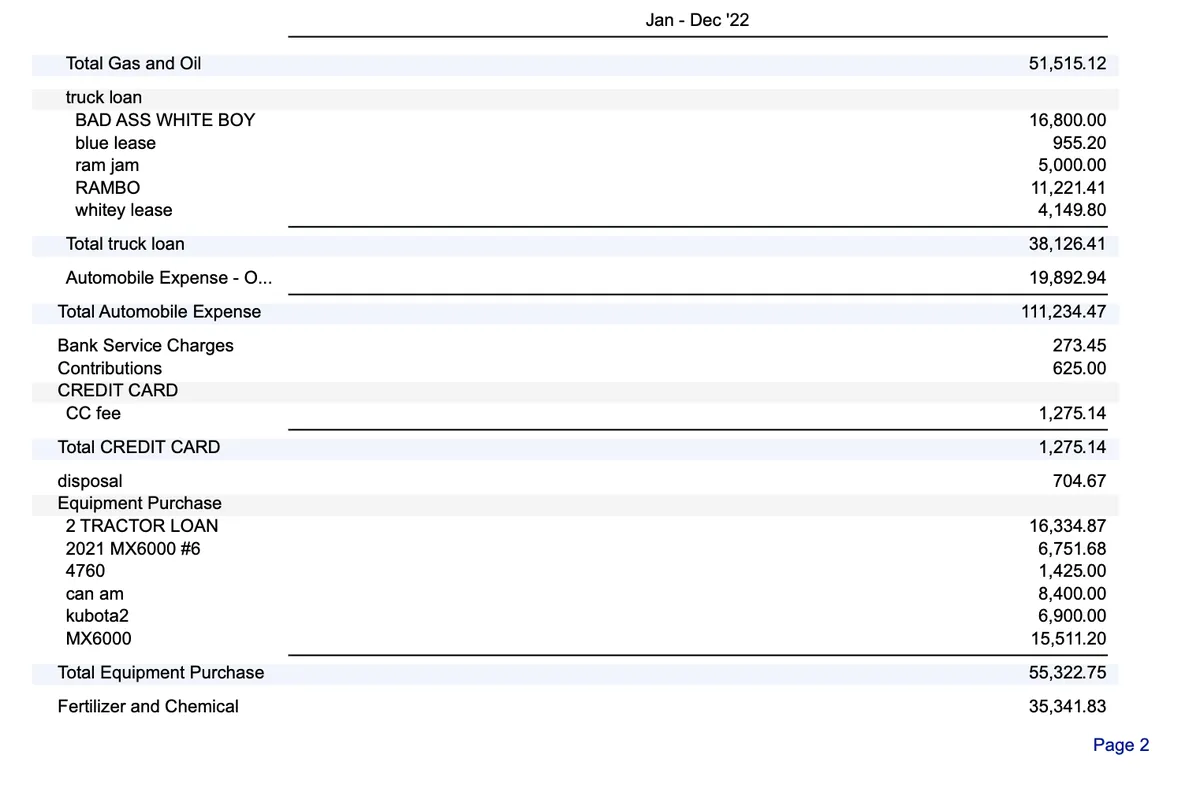

- Lots of loans on different trucks

- Are the equip one time or on going

- Interest expense is add back

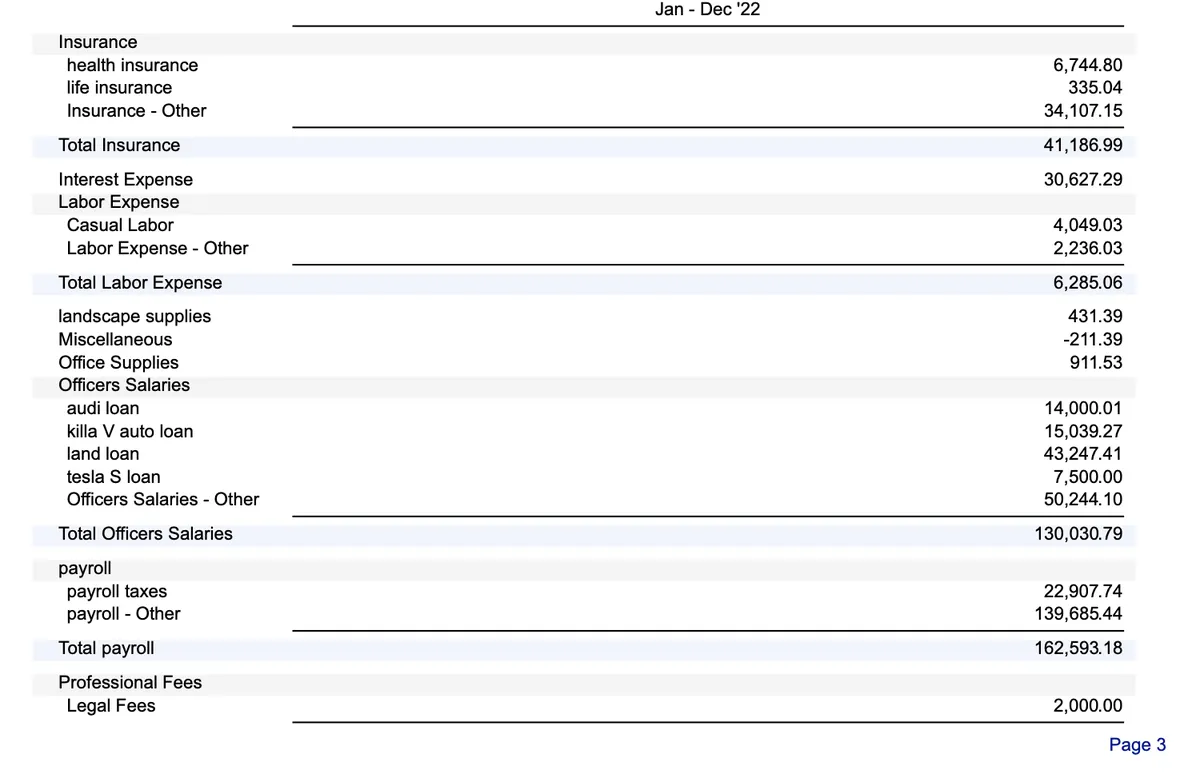

- Officer salary (himself)

- Land loan? Rent for facility or something unrelated

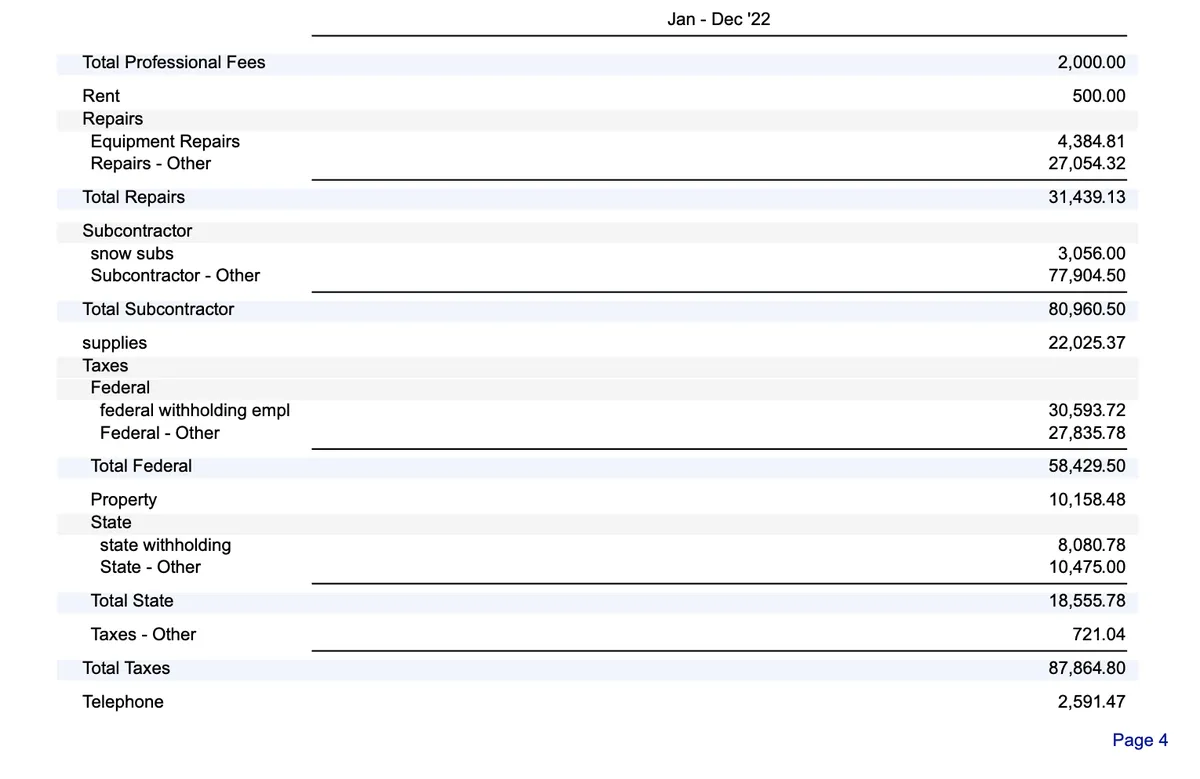

- Payroll - keep

- Subs - keep

BLURB: Great to connect, excited to talk. Before we do, we wanted to understand a bit about this deal

2023

- What is the solar loan?

- Equip purchases? Are they leases? Constantly buying new stuff?

BLURB: Hey it look like you’ve gone from break even to now. Whats driving that? Is it sustainable? Where do you see the business going?

Don’t just look at the total income, scroll to the end and see what the NET is. In this case, it’s $6k. This tells me theres some fancy tax moves going. On that you’ll note and ask about later

You’ll need all the subcontractor expenses, and you might even want to account for more in the future if you want to make this operationally light.

The Officer salaries is the owner paying himself. On top of his other profits. And included in that are the cars. Something to note is the land loan. What is that for? I’m not sure, so I’ll ask. That’s all it takes. You see something and say something.

Be curious.

Several personal looking truck loans. Those will most likely be add backs and not included in the sale. Clarify that with him. Maybe they’re company trucks. Worth asking. Also, are all of them needed? Again, note these down and ASK.

This is actually the first page that I looked at. I wanted to compare the Total Income with the Net Income. Also, what’s the auto purchase? Is that one time?

Again, this is a high level overview. The more you look at these the more you’ll start to see patterns show up or things stand out as odd. From here I’m going to break this down on a call with the owner and then finish a pitch deck when I have enough to propose a valuation.